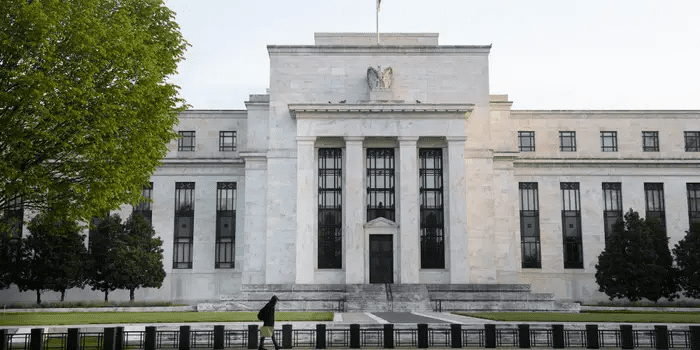

US: According to John Williams, president of the New York Fed, the evolution of digital currency and payment technologies may affect how the Federal Reserve conducts monetary policy and the composition of its balance sheet, issues that the central bank will need to investigate.

In his opening remarks at a Columbia University research conference, Mr. Williams stated, “Digital transformation could have ramifications for markets, our interactions with counterparties, and the way we conduct monetary policy.”

“What would a world of digital currencies such as stablecoins and (central bank digital currencies) mean for the implementation of monetary policy? How will monetary authorities plan and adapt?” In accordance with Williams

He stated that the function of central banks “will always be to provide money and liquidity in order to maintain economic and financial stability.” Nonetheless, “it is essential that we comprehend how these changes may impact the economy and financial system, as well as the implementation of monetary policy.”

The Federal Reserve is debating whether to create its own digital currency, and the administration of President Joe Biden is debating the regulation of cryptocurrencies and related technologies such as stablecoins.

Whether or not the Fed creates a digital dollar, the development of a network of private currencies, the expansion of stablecoin and crypto markets, and the expansion of private payment options could have a significant impact on banks and the legacy financial system that underpins central bank policy.