Gift Nifty Crashes 1.4% Ahead of Indian Market Open Amid Global Selloff

Key Highlights:

On April 11, 2025, the Gift Nifty 50 Index Futures dropped significantly, trading at 22,921.5, down 325.5 points or 1.40% as of 06:31 AM IST. This sharp decline mirrors a global risk-off sentiment sparked by fresh U.S.-China trade tensions and a tech-led collapse on Wall Street.

The fall in Gift Nifty suggests a gap-down opening for Indian benchmark indices Nifty 50 and Sensex when trading resumes today after the April 10 holiday for Mahavir Jayanti.

What Triggered Gift Nifty’s Fall?

The major catalysts include:

- Trump’s Tariff Move: U.S. President Donald Trump announced a 125% tariff on Chinese goods, reigniting fears of a trade war.

- Nasdaq Plunge: Nasdaq Composite nosedived 4.31%, led by sharp losses in mega-cap tech stocks.

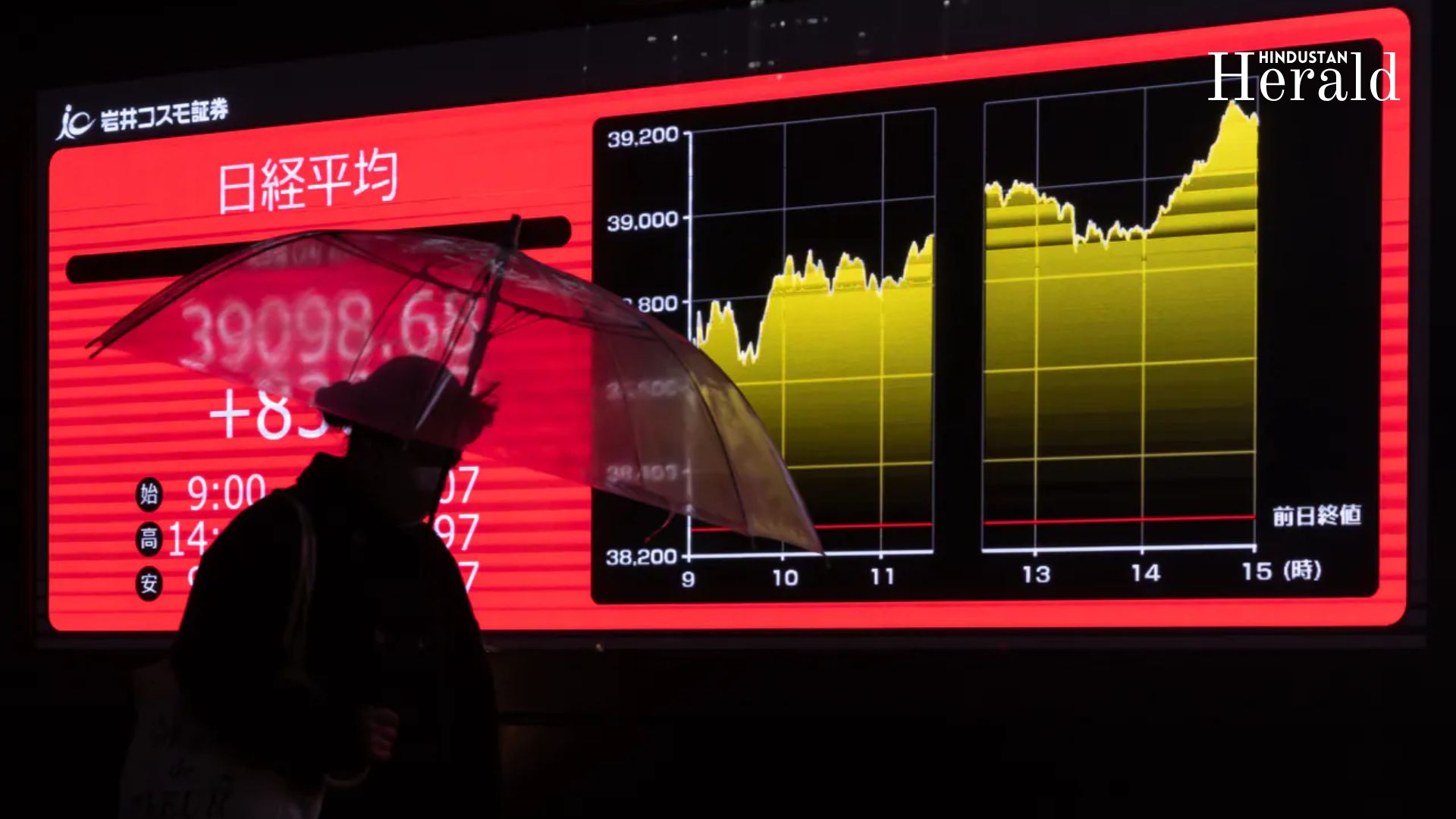

- Asian Market Reaction: Nikkei 225 fell 5.12%, KOSPI 1.60%, and Hang Seng dropped 2.10%.

- Crude Oil & Commodities: Weak energy prices and demand fears added to bearish global sentiment.

Implications for Nifty 50 and Indian Markets

Given Gift Nifty’s sharp dip, the Nifty 50 could open below the critical 22,900 level, with downside pressure in IT, FMCG, and banking stocks.

Sectors to watch:

- IT stocks (Infosys, TCS, HCL Tech): May extend losses in sync with Nasdaq.

- Banks (HDFC Bank, ICICI Bank): Risk-off mood may weaken investor appetite.

- Auto & Energy: Could see selling amid global slowdown fears.

- Midcaps and Smallcaps: Likely to underperform as volatility spikes.

Technical Outlook

- Immediate Support: 22,800

- Resistance Level: 23,150

- Volatility Indicator: India VIX expected to rise in early trade

Analyst View

“Gift Nifty’s sharp slide is a red flag for domestic equities. Global cues are extremely negative and profit booking is likely across sectors,” says Ravi Menon, Senior Technical Analyst at Angel One.

“We expect a volatile session with potential recovery in the second half, depending on institutional flows,” added Neha Rathi, Derivatives Strategist at Motilal Oswal.

Cautious Start Ahead for Indian Equities

The Gift Nifty today offers a clear pre-market signal of stress in the Indian equity market. Traders should brace for a choppy session, adjust stop-losses, and avoid aggressive long positions at the open. Global triggers will dominate sentiment through the day.

The Hindustan Herald Is Your Source For The Latest In Business, Entertainment, Lifestyle, Breaking News, And Other News. Please Follow Us On Facebook, Instagram, Twitter, And LinkedIn To Receive Instantaneous Updates. Also Don’t Forget To Subscribe Our Telegram Channel @hindustanherald