ITC Share Price Edges Up to ₹425 Amid Stable Trade, Dividend Yield Remains Attractive

ITC Ltd's share price rose slightly by 0.13% on April 17, closing at ₹425, as the stock maintained range-bound movement amid cautious market sentiment.

Key Highlights:

The ITC share price saw a marginal gain on April 17, 2025, ending the day at ₹425.00, up ₹0.55 (0.13%) from the previous session. The stock traded in a tight range, with no intraday volatility, maintaining a steady tone in line with broader market behavior.

Day’s Summary: Flat but Firm Performance

- Open: ₹425.00

- High: ₹425.00

- Low: ₹425.00

- Close: ₹425.00

ITC Ltd traded flat throughout the session, reflecting limited trader participation but consistent interest from long-term investors.

Valuation and Yield Outlook

- Market Cap: ₹5.32 lakh crore

- P/E Ratio: 26.40

- Dividend Yield: 2.41%

- 52-Week High: ₹528.50

- 52-Week Low: ₹390.15

The attractive dividend yield of 2.41% continues to appeal to income-seeking investors. Its P/E ratio of 26.40 keeps it within fair valuation territory compared to peers in the FMCG sector.

Why Did ITC Remain Stable Today?

Several factors contributed to the sideways movement:

- Market-wide volatility limited fresh inflows into individual counters.

- FMCG sector showed resilience as investors leaned toward defensive stocks.

- There were no major triggers or corporate updates, keeping the price action muted.

- Investors are watching out for the upcoming Q4 earnings which could influence stock direction.

Investor Sentiment and Institutional Positioning

- Retail investors continue to show interest in ITC for its consistent dividend payouts.

- Institutional investors remained on the sidelines, awaiting quarterly results and forward guidance.

- The stock’s flat trajectory suggests accumulation mode rather than active trading.

Analyst View: Slow But Steady

Market experts suggest:

- ₹420 is acting as a strong support level, with potential upside capped near ₹435 in the short term.

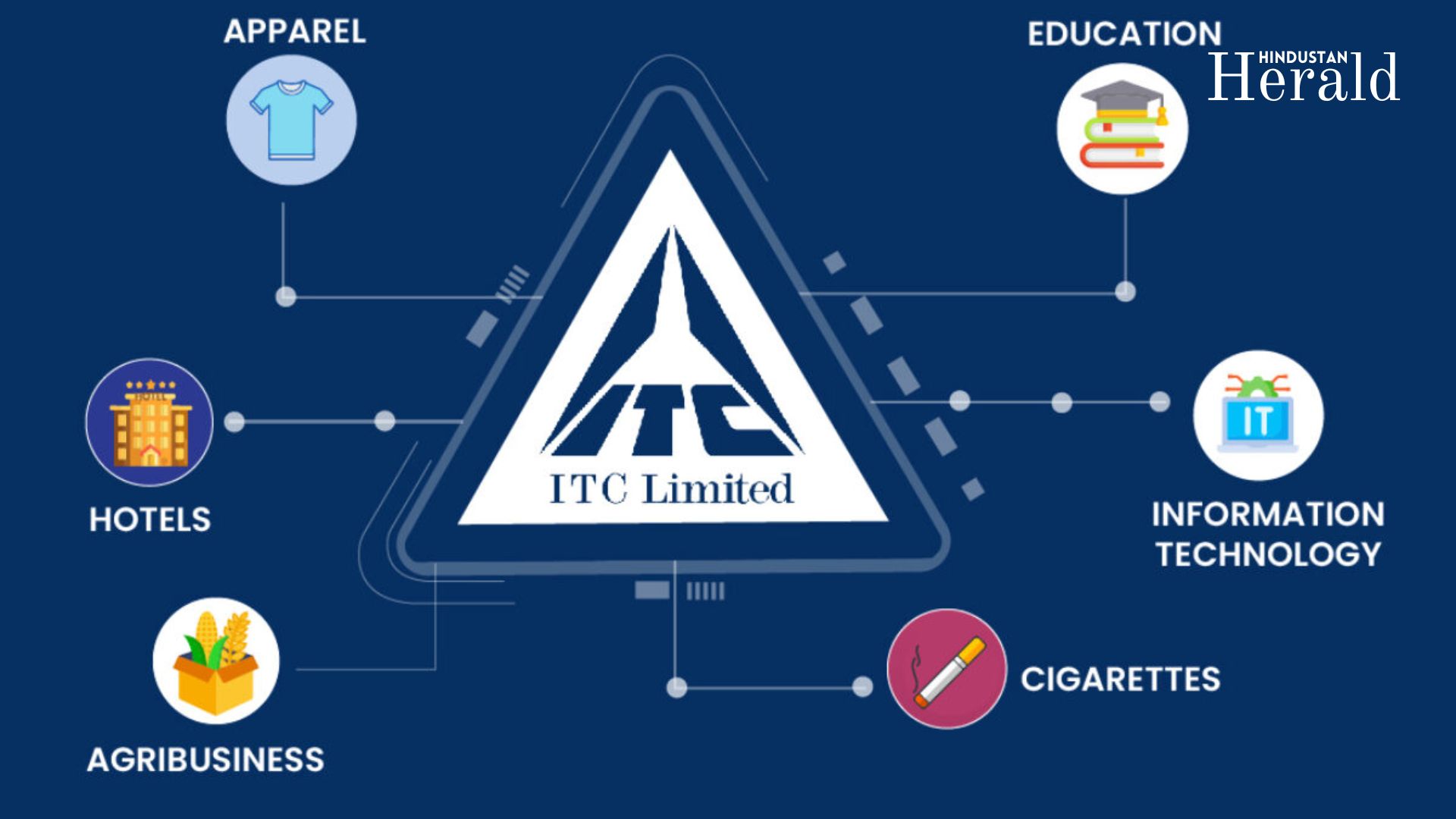

- Long-term investors see value in ITC due to its diversified portfolio in FMCG, hotels, and paper.

- The stock is seen as a safe-haven bet in volatile markets due to its stable cash flows.

What This Means for You

If you’re a trader:

- ITC is not a high-momentum stock but ideal for low-risk strategies.

- Range-bound movement makes it suitable for options writing or short-term positional trades.

If you’re an investor:

- Dividend stability and sectoral strength make ITC a strong candidate for core portfolio holding.

- Consider accumulating near ₹420–₹425 levels for long-term growth and income potential.

How to Take Action

- Monitor ITC’s Q4 earnings closely — expected soon — for future guidance.

- Keep an eye on FMCG sector trends and inflationary inputs which may affect margins.

- Use SIPs or staggered investments to average entry points in case of minor dips.

Who Will Be Affected

- Long-term investors favoring high dividend stocks.

- Mutual funds with exposure to FMCG and defensive plays.

- Retirement-focused portfolios looking for stability and income over growth.

ITC Share Price Shows Calm Strength at ₹425

The ITC share price demonstrated stability in a volatile environment, underscoring its status as a dependable stock for conservative portfolios. With a healthy dividend yield and limited downside risk, ITC remains a preferred choice for long-term investors. The stock’s ability to hold firm near ₹425 reaffirms its base and sets the stage for gradual upside pending future catalysts.

The Hindustan Herald Is Your Source For The Latest In Business, Entertainment, Lifestyle, Breaking News, And Other News. Please Follow Us On Facebook, Instagram, Twitter, And LinkedIn To Receive Instantaneous Updates. Also Don’t Forget To Subscribe Our Telegram Channel @hindustanherald