ITC Ltd. Edges Up 0.56% to ₹422.75 in Early Trade on 16 April 2025

ITC Ltd. witnessed a slight yet encouraging gain of 0.56% today, climbing to ₹422.75 amid stable investor sentiment in FMCG heavyweights.

Key Highlights:

On 16 April 2025, ITC Ltd. recorded a 0.56% increase in its share price during early trading hours, taking the stock up by ₹2.35 to ₹422.75. The stock saw steady momentum as it opened higher and continued to rise, supported by a stable outlook for India’s consumer goods and tobacco sector.

Key Stock Metrics:

- Previous Close: ₹420.40

- Opening Price: ₹418.00

- Day’s High: ₹423.00

- Day’s Low: ₹418.00

- Market Cap: ₹5.29 Lakh Cr

- P/E Ratio: 26.27

- Dividend Yield: 2.42%

- 52-Week High: ₹528.50

- 52-Week Low: ₹390.15

Why ITC is Gaining Ground Today

Several factors have contributed to ITC’s upward move today:

- Investor Confidence: A consistent performer in the FMCG segment, ITC’s stability is drawing investor interest amid ongoing market volatility.

- Dividend Yield Appeal: With a 2.42% yield, ITC remains a favorite for long-term dividend-focused investors.

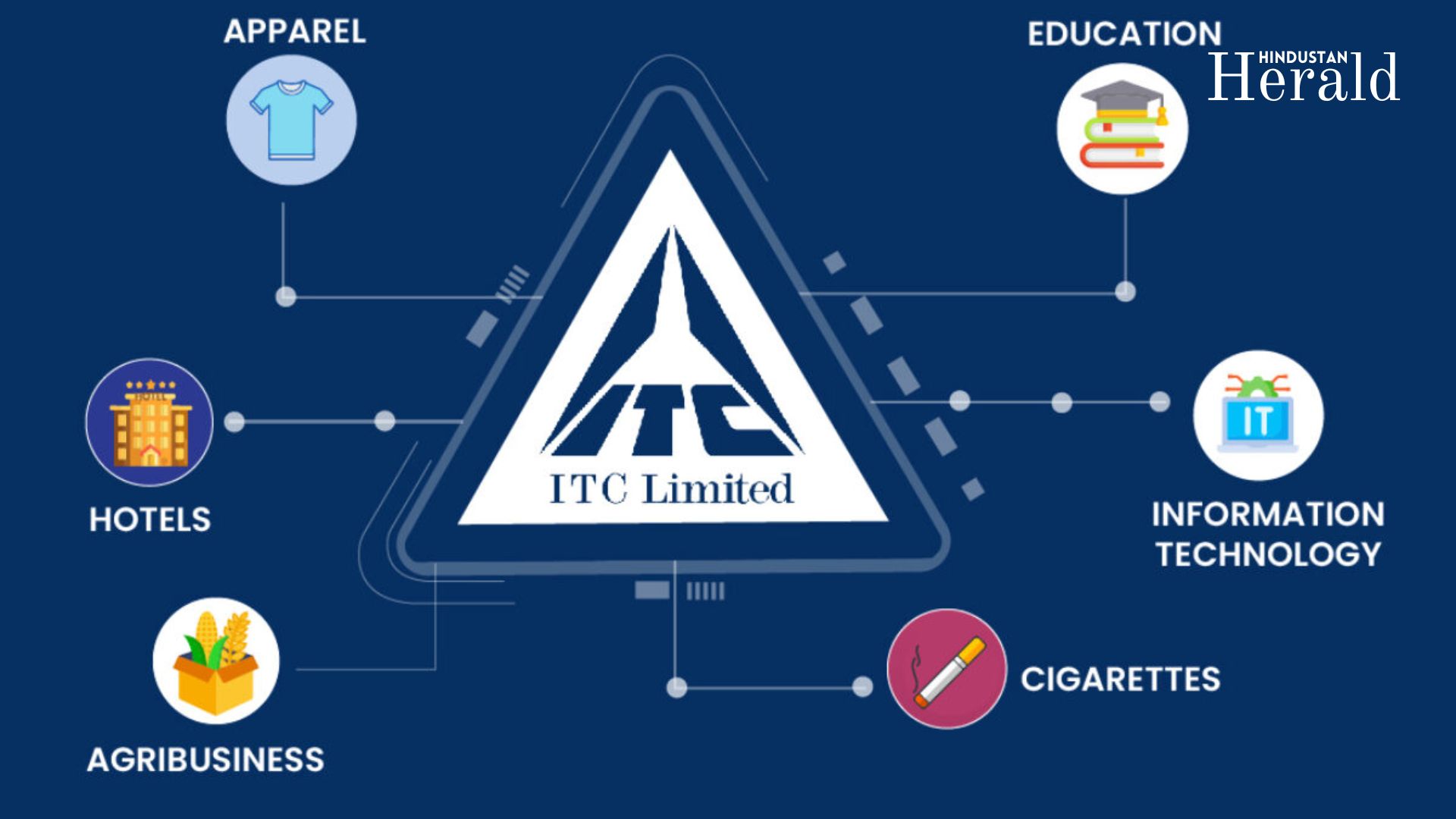

- Portfolio Stability: The company’s mix of cigarettes, packaged foods, paperboards, and hotels provides diversification and earnings consistency.

The modest gain today mirrors a sentiment of cautious optimism, where investors are slowly turning to defensives like FMCG and pharma stocks.

Technical Outlook: Is There More Upside?

ITC is showing positive price action above ₹420. The immediate support level sits at ₹418, while resistance lies around ₹425. If the stock breaks above ₹425, it could quickly test ₹430 and ₹440 in the short term.

Momentum indicators show a slight bullish bias, but volumes remain average, suggesting more buying strength will be needed to push the stock significantly higher.

Key Support and Resistance Levels

- Support: ₹418, ₹412

- Resistance: ₹425, ₹430

A move above ₹425 may attract intraday momentum players, while a slip below ₹418 could lead to mild profit-booking.

ITC Remains a Steady Performer

It’s 0.56% gain today showcases investor confidence in stable, dividend-paying stocks amidst ongoing market churn. With strong fundamentals, a solid brand portfolio, and consistent returns, It remains a preferred pick for long-term investors and conservative portfolios.

Short-term traders can watch for a breakout above ₹425 for near-term gains, while long-term investors can continue to hold with confidence.

The Hindustan Herald Is Your Source For The Latest In Business, Entertainment, Lifestyle, Breaking News, And Other News. Please Follow Us On Facebook, Instagram, Twitter, And LinkedIn To Receive Instantaneous Updates. Also Don’t Forget To Subscribe Our Telegram Channel @hindustanherald