Nikkei 225 Crashes Over 5% in Early Trade as Global Tech Selloff Hits Japan Markets

Key Highlights:

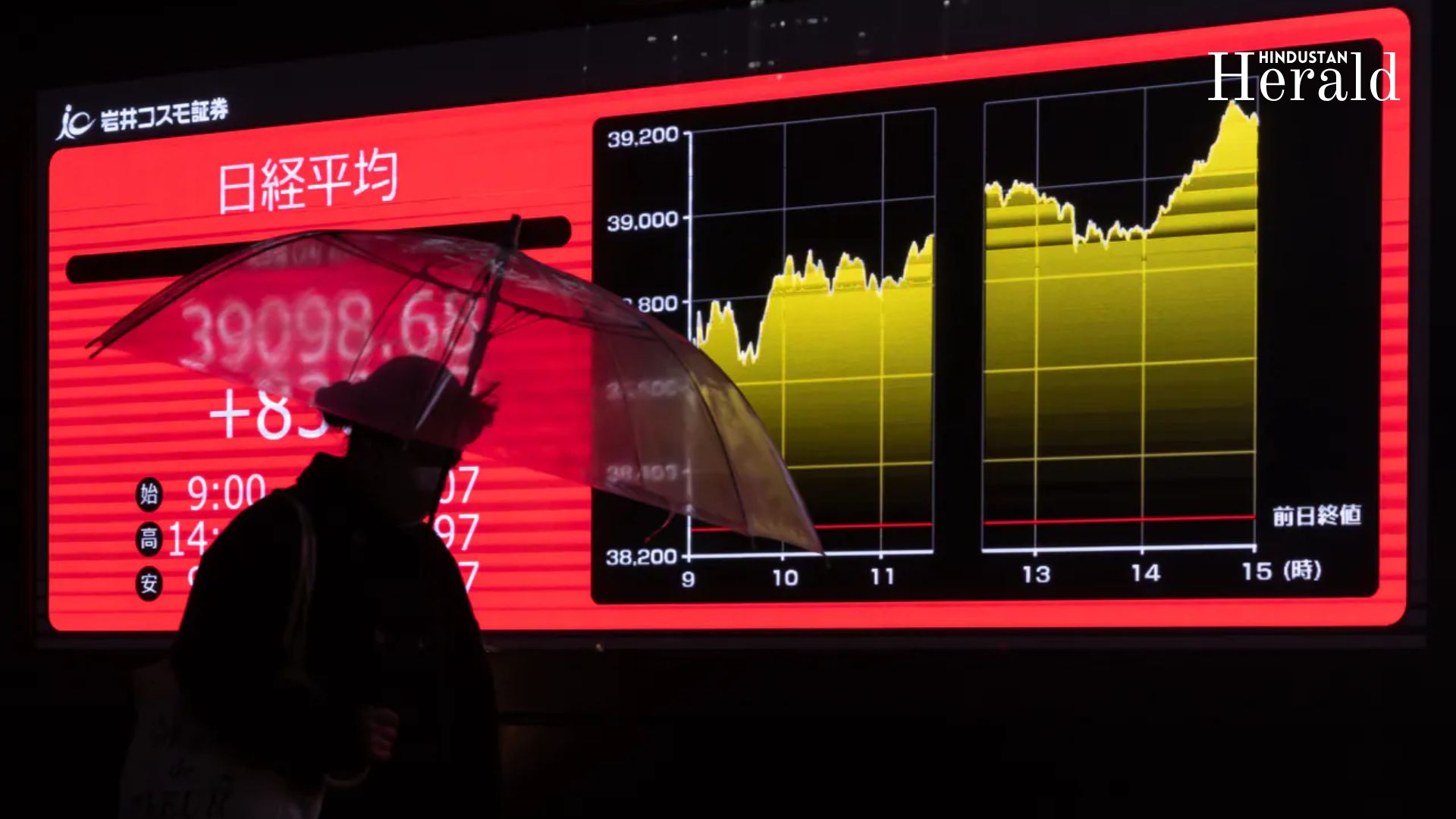

In a dramatic turn of events, the Nikkei 225 opened deep in the red on 11 April 2025, falling 1,771.33 points or 5.12% to 32,837.45, as of 05:44 AM IST. The sharp drop reflects investor panic following a brutal selloff in U.S. tech stocks that wiped out billions in market cap overnight.

The Nikkei had surged over 2,800 points (9.13%) on 10 April in response to an international tech-led rally, but Friday’s early session shows the fragility of that recovery.

Nikkei 225 – Live Market Snapshot

| Metric | Value |

|---|---|

| Current Value | 32,837.45 |

| Change | -1,771.33 |

| Change (%) | -5.12% |

| Previous Close | 34,608.78 |

The intraday chart shows a steep vertical drop right at the open, signaling institutional sell orders and risk-off sentiment dominating the Tokyo Stock Exchange.

What’s Triggering the Nikkei Selloff?

1. Nasdaq Collapse

The Nasdaq Composite dropped 737 points (-4.31%) on Thursday, triggering a tech panic that echoed through Asian markets.

2. Profit Booking After Historic Rally

After a record gain of 9.13% on 10 April, investors are quickly locking in profits, especially in export-heavy and tech-driven stocks.

3. Rising U.S. Inflation Fears

U.S. CPI data surprised to the upside, pushing back expectations for Federal Reserve rate cuts. This has led to global risk aversion.

4. Yen Volatility

The Japanese yen strengthened slightly, adding pressure on exporters and multinationals.

Sector Breakdown

- Technology & Electronics: Sharpest declines, mirroring U.S. Big Tech losses

- Automotive (Toyota, Honda): Down due to currency concerns

- Financials: Mixed as yields fluctuate

- Retail & Pharma: Mildly defensive but also under pressure

Technical Outlook: Breakdown Confirmed

| Level Type | Value |

|---|---|

| Immediate Support | 32,500 |

| Breakdown Zone | 32,200 |

| Upside Resistance | 33,500 |

Analysts suggest that if 32,500 fails to hold, the index could slide another 1–2% intraday. However, support buying could emerge if U.S. futures stabilize.

Analyst Commentary

“Yesterday’s surge was emotional. Today’s crash is rational,” said Takashi Ito, equity strategist at Nomura. “The Nikkei is simply mirroring the Nasdaq’s pain — but magnified due to leveraged positioning.”

“If U.S. futures continue lower, expect another 500–700 point drop intraday,” warned Reika Matsuda, head of global macro strategy at Mizuho Securities.

Volatility Returns to Tokyo Markets

The Nikkei 225’s 5% plunge underscores how quickly global risk sentiment can reverse. While yesterday’s rally hinted at recovery, today’s sharp correction serves as a sobering reminder of macro uncertainty.

Investors are advised to tread cautiously as earnings season begins and central bank policies remain under scrutiny. All eyes will now turn to U.S. retail sales data and bond market moves for further cues.

The Hindustan Herald Is Your Source For The Latest In Business, Entertainment, Lifestyle, Breaking News, And Other News. Please Follow Us On Facebook, Instagram, Twitter, And LinkedIn To Receive Instantaneous Updates. Also Don’t Forget To Subscribe Our Telegram Channel @hindustanherald