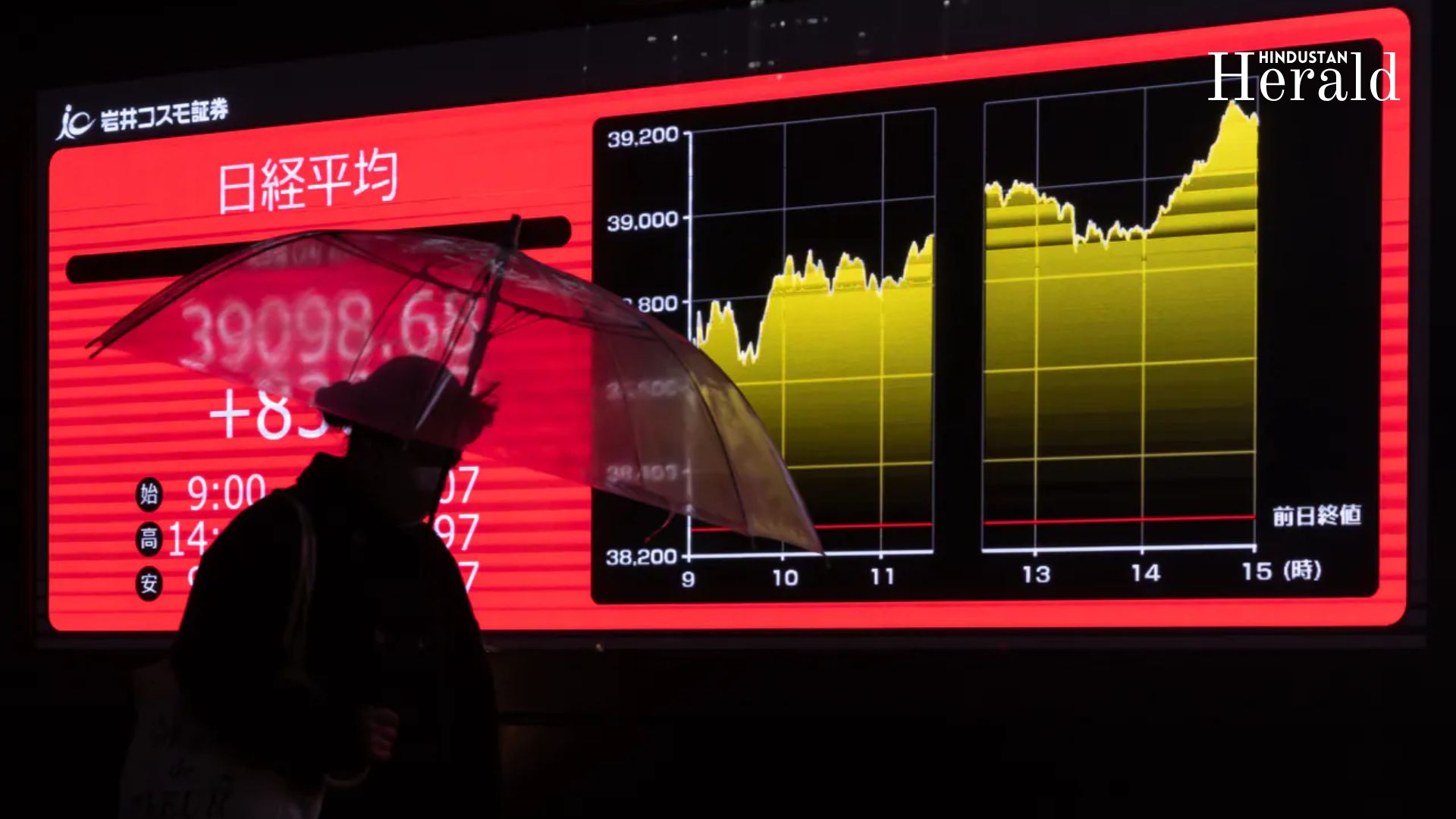

Nikkei 225 Prediction for April 14: Futures Surge 180 Points as Global Momentum Gathers Pace

Key Highlights:

Tokyo, April 14 (IST):

The Nikkei 225 Futures surged +180.0 points (+0.53%) to ¥33,887.5 early Monday, offering relief to traders after the index’s steep 1,000+ point fall on April 11. The uptick signals a potential recovery for Japanese equities, bolstered by Wall Street gains, positive futures sentiment, and modest easing in global trade fears.

Nikkei 225 Recap: April 11 Closing Performance

- Previous Close: ¥34,609.00

- Close (April 11): ¥33,585.58

- Change: -1,023.42 points (-2.96%)

- Day’s Low: ¥32,626.58

- 52-Week High: ¥42,426.77

- 52-Week Low: ¥30,792.74

The dramatic fall on Friday was driven by:

- Broad selloff in tech and exporters

- Yen strength pressuring earnings outlook

- Risk-off sentiment over U.S.-China trade escalation

Global Cues Support a Rebound

On April 11, U.S. indices staged a powerful comeback:

- Nasdaq Composite: +2.06%

- S&P 500: +1.80%

- Dow Jones: +1.60%

This surge came amid:

- Cooling U.S. inflation signals

- Positive earnings from U.S. banks

- Market hope for a pause in further U.S.-China tariff escalation

The result? Asian futures turned positive, with the Nikkei 225 Futures leading the pack into April 14’s session.

Technical Forecast: Nikkei 225 on April 14

- Futures Level: ¥33,887.50

- Immediate Resistance: ¥34,200

- Support Zone: ¥33,400

- Market Bias: Cautiously Bullish

- Indicators:

- MACD still negative but flattening

- RSI recovering from oversold territory

If cash markets open above ¥33,900, traders may target a technical bounce toward ¥34,200–34,300, where the next resistance lies.

Sector Watch: What Could Move Today

- Exporters & Auto Stocks: May gain if the yen stabilizes

- Semiconductors: Could rebound, tracking Nasdaq strength

- Financials: Eyeing U.S. rate expectations and BOJ signals

- Defensive Stocks: May see rotation if global sentiment stays mixed

Trade War Risk Still Lingers

Despite hopes of easing, both the U.S. and China have ramped up tariffs, impacting Japanese companies with exposure to both economies. Traders should stay alert for:

- Policy statements from Washington and Beijing

- BOJ commentary on inflation and currency trends

- Any movement in yen-dollar exchange rates

Nikkei 225 Prediction for April 14

Based on futures momentum and global cues:

- Expected Opening Range: ¥33,850 – ¥34,100

- Intraday Bias: Slightly Bullish

- Potential High: ¥34,300 if momentum sustains

- Caution Level: ¥33,400 (if early gains fade)

If early buying continues, a short-covering rally may push the index back above ¥34,000, reversing part of Friday’s losses.

The Nikkei 225 looks set to open with a positive bias on April 14, with futures pointing to recovery and global sentiment improving. However, geopolitical risks and trade policy noise remain key overhangs. Short-term gains are likely, but traders will need to stay nimble as macro uncertainty persists.

The Hindustan Herald Is Your Source For The Latest In Business, Entertainment, Lifestyle, Breaking News, And Other News. Please Follow Us On Facebook, Instagram, Twitter, And LinkedIn To Receive Instantaneous Updates. Also Don’t Forget To Subscribe Our Telegram Channel @hindustanherald