Nikkei 225 Outlook for April 23: Will Nasdaq’s Rally Power a Positive Start?

Nikkei 225 is set for a crucial open today after Nasdaq surged 2.71% overnight. Will Tokyo markets respond with strength or stay cautious amid global volatility?

Key Highlights:

Nikkei 225 Prediction Today: Will Nasdaq’s Rally Set the Tone?

The Nikkei 225 opens today, April 23, amid heightened optimism following a dramatic 2.71% surge in the Nasdaq Composite. With global equities rallying on Wall Street and investors awaiting critical economic cues from Asia, Japan’s benchmark index faces a pivotal session.

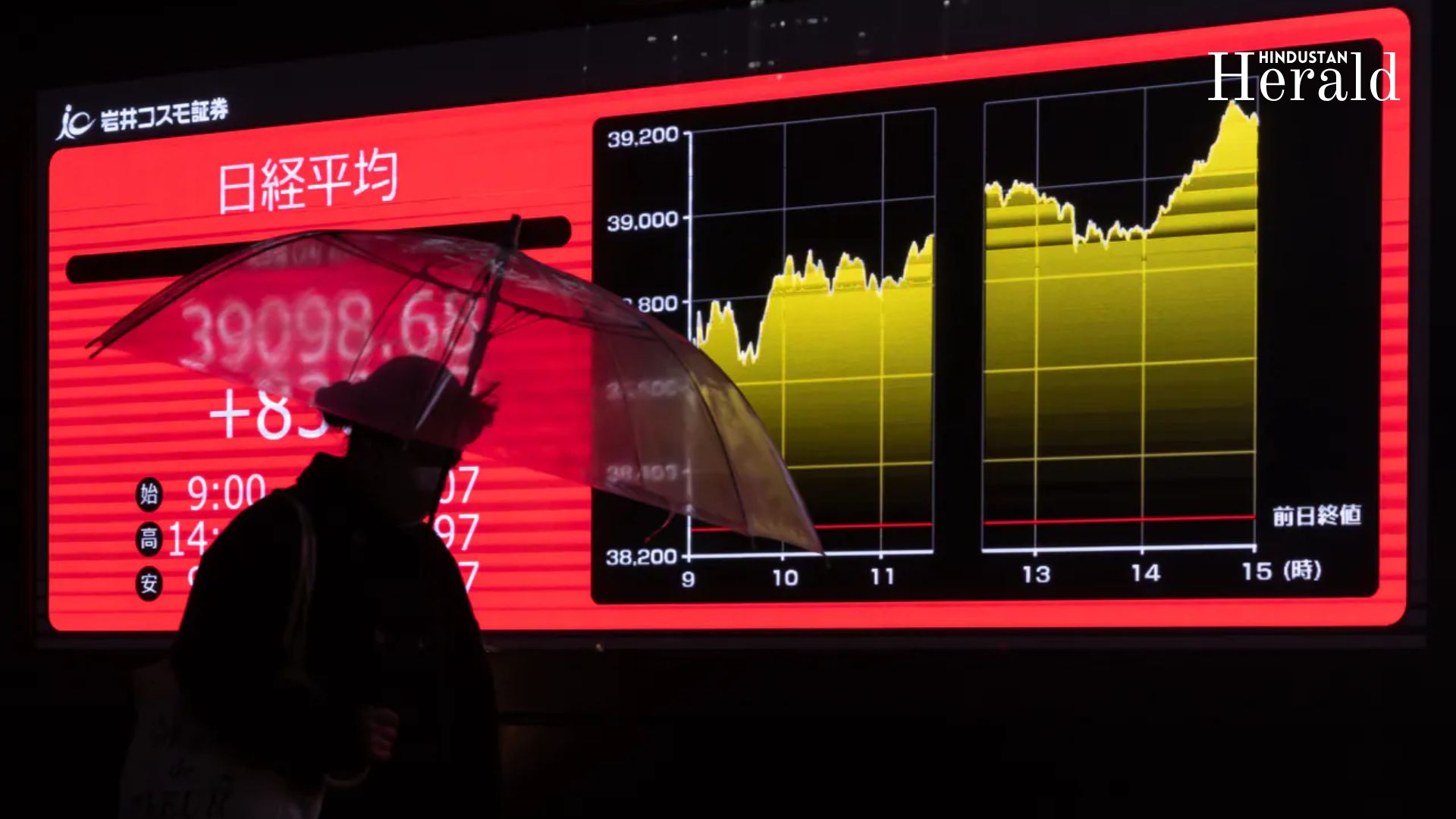

How Nikkei Performed on April 22

On Monday, April 22, the Nikkei 225 closed at 34,220.60, down 59.32 points (0.17%) from the previous session’s close of 34,279.92. Here’s a quick snapshot:

- Opening Value: 34,111.14

- High: 34,340.57

- Low: 34,109.85

- 52-Week Range: 30,792.74 – 42,426.77

While the index began on a promising note, intraday volatility and profit-booking pulled it into negative territory by the closing bell.

Nasdaq’s Performance: A Global Signal

On April 22, the Nasdaq Composite ended the day at 16,300.42, gaining 429.52 points (2.71%). The rally was broad-based, fueled by:

- Investor optimism around mega-cap tech stocks

- Positive earnings momentum in the U.S.

- Dip-buying interest in growth sectors

This performance is expected to influence Asian equities, especially tech-heavy indices like the Nikkei.

Key Drivers for Today’s Nikkei Opening

1. U.S. Tech Rally to Influence Tokyo

The overnight surge in Apple, Amazon, and Nvidia could boost Japanese technology and semiconductor firms such as Sony, Tokyo Electron, and Advantest. With global appetite for tech returning, Nikkei could see sector-specific gains.

2. Yen Movement Supports Exporters

The yen traded weaker against the U.S. dollar overnight, a favorable scenario for Japanese exporters. A soft currency boosts the profit margins of multinational firms listed on the Nikkei, making them attractive to foreign investors.

3. Global Sentiment and Risk-On Mode

Broader Asian market cues, especially from South Korea’s Kospi and Taiwan’s Taiex, are expected to align with Wall Street’s momentum. If risk appetite persists, Tokyo markets could rally in tandem.

Who Will Be Affected

- Retail investors seeking short-term momentum trades

- Fund managers with exposure to Japanese equities or global tech

- Export-centric firms like automakers and electronics majors

What This Means for You

For investors and traders, today’s Nikkei session could offer significant intraday opportunities, particularly in high-beta sectors. A positive start is likely, but profit-booking at resistance zones remains a possibility.

How to Take Action

- Watch early movement in Sony, SoftBank, Toyota, and chip-related counters

- Consider reviewing Nikkei 225 ETFs or futures ahead of the opening bell

- Stay cautious of global headlines, especially from the U.S. earnings season and any potential geopolitical updates

Final Market Sentiment Before Opening Bell

Given Nasdaq’s explosive rally and the global risk-on tone, the Nikkei 225 is likely to start on a bullish note on April 23. However, caution may prevail later in the session as investors weigh macroeconomic data and prepare for upcoming earnings from Japanese corporates.

Keep your eyes on intraday sector rotations and technical resistance around the 34,400 mark. This could be the level where bulls either consolidate or give way to mild corrections.

Stay updated with the latest from Hindustan Herald — your trusted source for

Politics, Business, Sports, Entertainment, Lifestyle, Breaking News, and More.

📲 Follow us on Facebook, Instagram, Twitter, LinkedIn, and YouTube

🔔 Join our Telegram channel @hindustanherald for real-time news alerts.