Due to the company’s high level of debt relative to the Reliance conglomerate, CreditSights has warned investors about the risks associated with the Adani Group’s expansion bid. According to a credit research firm’s report, the group’s “overly-ambitious debt-funded growth plans” will lead to a massive debt trap and, eventually, the distress or default of one or more group companies. This is due to the company’s “overly-ambitious debt-funded growth plans,” according to the research firm.

The report addresses several major financial issues that have plagued the Adani Group and concerned market analysts and shareholders.

Several credit concerns have been compiled in the credit report, including the group’s overly-leveraged aggressive expansion into new or unrelated businesses, environmental, social, and governance (ESG) risks, risks associated with competing with companies such as Reliance Industries, and, finally, limited evidence of equity capital injections by Gautam Adani and his family.

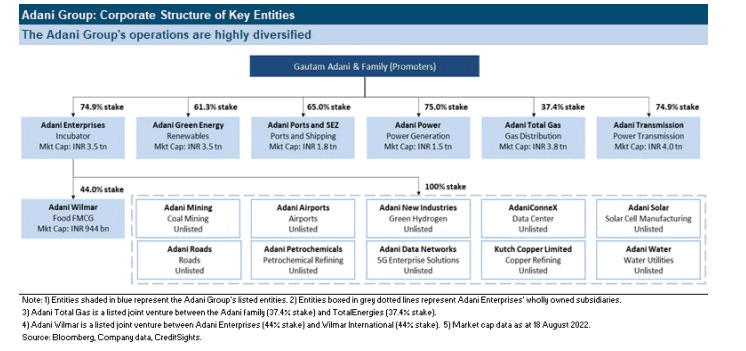

With a market capitalization of more than $200 billion as of August 2022, the Adani Group is India’s third largest conglomerate, trailing only the Reliance Group and the Tata Group. When determining a company’s position on this list, all of its stock is taken into account. Gautam Adani founded the Group in 1988 as a commodity trading firm. Since its inception, the Group has expanded rapidly, particularly in the energy, utilities, and transportation sectors. The Adani Group is comprised of six established listed entities: Adani Enterprises (AEL), Adani Green Energy (AGEL), Adani Ports and Special Economic Zone (APSEZ), Adani Power, Adani Total Gas, and Adani Transmission.

The report warns that CreditSights is “cautiously watching” the Adani Group’s largely debt-financed expansion appetite.

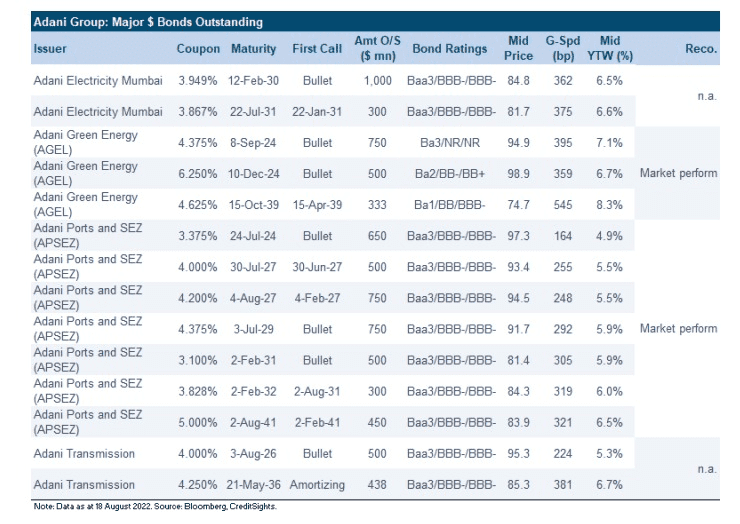

“As a result of its aggressive investment in both existing and new businesses with debt as the primary source of funding, the company’s leverage and solvency ratios have increased.” Understandably, concerns have been raised about the entire group and the implications for the group’s bond-issuing companies. The worst-case scenario for overly ambitious growth plans funded by debt is a distressed situation or the default of one or more group companies.

It goes on to say that debt financing has been a significant contributor to the rapid expansion, causing “the leverage (gross or net debt/EBITDA) of several Group companies, and thus of the overall consolidated group, to soar in recent years.” [A footnote is required] “EBITDA” (earnings before interest, taxes, depreciation, and amortization) refers to a company’s profit before these costs are deducted.

According to the report, “Excessive debt and overleveraging by the Group” raises the risk of contagion if any entity within the group experiences financial difficulties, as it may have a negative impact on the credit quality of the group’s bond issuing entities.

Each of the CreditSights-identified issues is discussed in greater detail below.

Uncharted market penetration and rapid expansion within established businesses

Exploration of new markets and aggressive expansion of existing ones

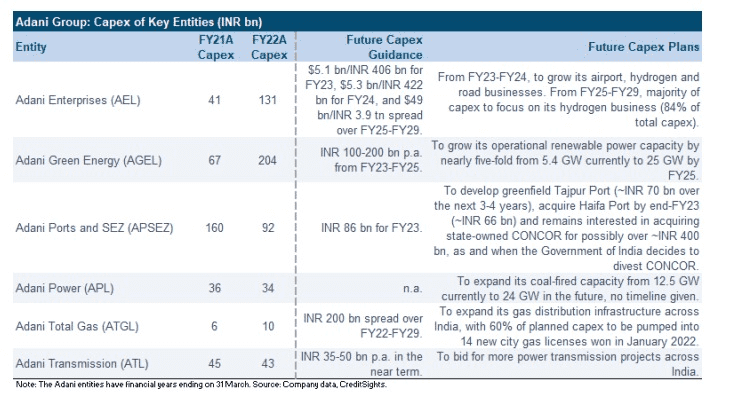

According to the report, the company has expanded rapidly within its existing business segments and has seen overall growth. Adani Green is one such company, with plans to nearly double its operational renewable capacity by the end of fiscal year 25.

The company also intends to enter new markets in which it has not yet established itself or developed any particular expertise. Such industries include copper processing, petrochemical manufacturing, data center construction, and even telecommunications and aluminum production. According to CreditSights, the Adani Group “virtually overnight” became the world’s second largest cement producer after purchasing Holcim’s controlling stake in Ambuja Cement and ACC Limited for $10.5 billion. As a result, the Adani Group has surpassed Holcim to become the world’s largest cement producer.

Because of the lengthy development times of these projects, the majority of Adani Group-managed businesses are capital-intensive. This means they will require significant capital expenditures at the outset, as well as ongoing funding for the duration of their existence.

Borrowings are a major source of funding for most projects and businesses (typically making up three times as much of the total funding as equity). Borrowing costs for infrastructure projects in India can range from 9-11% per year (depending on domestic benchmark rates), putting a significant financial strain on the financed organizations.

Furthermore, because most businesses do not make a profit in their first few years of operation, they are typically unable to repay the debt immediately and must instead rely on rolling over or refinancing the obligations during those first few years. Similarly, stable banking relationships and a healthy capital market are required.

After describing the difficult conditions that exist in the Indian ecosystem, the report issues the following warning:

Despite the fact that “elevated leverage levels and poor interest cover” exist due to the group’s history of rapid expansion and the high capital expenditures required by its current and planned projects, the majority of which were financed through debt, Adani Group companies have adopted aggressive growth targets.

Adani Enterprises Limited in the spotlight

Because it serves as the primary incubator for new and developing businesses, Adani Enterprises Limited (AEL) has the highest capital expenditure (CapEx) cost of any group company. The company has made significant investments in emerging markets such as aviation, cement, copper refining, data centers, green hydrogen, petrochemical refining, paving, and solar cell production over the last five years. In the future, the company plans to significantly expand its green hydrogen and airport businesses, as well as enter the enterprise data market within the telecommunications industry.

“These ventures are also extremely capital intensive (as seen in the table above),” according to the report, “which would likely increase the need for additional debt incurrence to fund the CapEx needs, resulting in sustained high leverage for the group.” [A footnote is required]

There is little evidence of equity capital injections.

Investors from Gautam Adani’s Adani Group or his family are an exception to the rule. The Adani family invests the majority of its wealth in its more recent ventures (which are all housed under AEL). They are separated out to run independently when they reach a certain maturity level, and the majority of their time is spent getting listed on a stock exchange. After that, the majority of a company’s funding must come from the debt capital market, internal accruals (also known as operating cash flows), and bank loans.

Gautam Adani’s meteoric rise to wealth is detailed in the report, including his recent achievement of surpassing Bill Gates to become the world’s fourth richest man. But it ends on a low note for Gautam Adani, who has seen the value of his Adani Group stock holdings skyrocket in recent years: “this is paper wealth, and largely tied to the value of his Adani Group stock holdings.” It is difficult to estimate the family’s capacity to invest their own money if any of the Group companies require equity injections from the promoter.

Because the six listed Group companies are separate legal entities, “providing inter-company loans by a performing company to its stressed sister entity would be a related-party transaction, raising corporate governance concerns,” according to the report.

Competing against Reliance Industries

CreditSights focuses on the bitter rivalry between the two major Indian business behemoths. RIL has announced that it will enter the renewable energy sector in 2021, the same year that Adani Green Energy Limited began operations. However, Reliance entered the telecom industry in 2015, and Adani quickly followed suit by bidding on and winning spectrum for India’s upcoming 5G network. It was no coincidence that both companies entered the market at the same time.

Although the Adani Group has repeatedly stated that it has no plans to enter the commercial consumer telecom market, the report does not rule out the possibility that it will do so in the future.

“As they compete for market share in a handful of new economy businesses, both of India’s mega conglomerates may make financially irresponsible moves, such as increased CapEx spending, aggressive bidding, and over-leveraging” (like renewable power and telecom). RIL has steadily reduced its debt load in recent years, and the company now has strong credit metrics, including a low leverage ratio (2.6x at the end of FY22) and a high interest coverage ratio (22.0%). (7.8x at FY22). Adani, on the other hand, is more financially vulnerable due to increased leverage, insufficient interest cover, and cash outflows across almost all of its entities.

Governance dangers

These mysterious funds share the same address in Port Louis, Mauritius, as a number of other foreign investors in Adani Group stock, including Albula Investment Fund, Cresta Fund, and APMS Investment Fund. These are just a few of the many international investors who have purchased Adani Group stock.

Although the vast majority of these funds’ assets under management (AUM) are held in Adani Group stock, the ultimate and beneficial owner of the funds is unknown. The Securities and Exchange Board of India (SEBI), India’s stock market regulator, conducted an investigation into stock price manipulation in 2017. However, SEBI has cleared the Adani Group companies of any wrongdoing since then.

The Promoter Group and foreign portfolio investors, some of whom are relatively unknown, account for a disproportionately large share of the stock’s holders, which is unusual for large-cap stocks. It’s also unusual for stocks in this market cap range to have so little equity research coverage from sell-side banks, both domestic and foreign.

The Hindustan Herald Is Your Source For The Latest In Business, Entertainment, Lifestyle, Breaking News, And Other News. Please Follow Us On Facebook, Instagram, Twitter, And Linkedin To Receive Instantaneous Updates. Also Don’t Forget To Subscribe Our Telegram Channel @heraldhindustan