ITC Ltd Opens Higher at ₹411.90, Closes at ₹409.90 Amid Defensive Buying on 8 April

Table of Contents

Mumbai, 8 April 2025 – Shares of ITC Ltd (NSE: ITC) climbed 0.95% today, ending the session at ₹409.90, up ₹3.85 from the previous close of ₹406.05. The stock opened strong at ₹411.90, hit an intraday low of ₹407.50, and showed resilience amid minor profit booking pressure in early trades.

This movement comes in a week where Indian equity markets are rebounding from a sharp fall on 5 April, with FMCG stocks like ITC playing a crucial role in balancing market volatility due to their defensive characteristics.

Quick Snapshot: Intraday and Technical Indicators

- Opening Price: ₹411.90

- Closing Price: ₹409.90

- Day’s High: ₹411.90

- Day’s Low: ₹407.50

- Previous Close: ₹406.05

- Market Cap: ₹5.13 Lakh Crore

- P/E Ratio: 25.46

- Dividend Yield: 2.50%

- 52-Week High: ₹528.50

- 52-Week Low: ₹390.15

The stock traded within a narrow range, reflecting subdued volatility but consistent interest from long-term defensive investors.

Sector Sentiment: Why FMCG Stocks Like ITC Are in Demand

The Fast-Moving Consumer Goods (FMCG) sector is historically favored during uncertain macroeconomic conditions due to its low beta and stable demand. The rally in ITC mirrors a defensive shift by investors who are:

- Cautious of tech and banking sector volatility

- Seeking stocks with reliable dividend income

- Looking for exposure to non-cyclical consumer staples

On 8 April, ITC benefitted from this broader theme, with investors parking funds in large-cap FMCG players.

Market Context: Index Support, Gift Nifty, and Peer Activity

The Nifty 50 gained over 285 points (+1.29%) today, and Sensex surged more than 875 points, reflecting a market-wide recovery. Additionally, Gift Nifty showed strong cues in early trading, suggesting a positive start.

Within the FMCG sector, ITC saw relative outperformance compared to peers:

| Company | Price (INR) | Day Change (%) |

|---|---|---|

| ITC Ltd | ₹409.90 | +0.95% |

| HUL | ₹2,432.45 | +0.52% |

| Nestlé India | ₹2,579.10 | +0.40% |

| Britannia | ₹4,521.30 | +0.33% |

ITC’s performance stands out as both volume-led and sentiment-driven, with relatively higher participation from institutional desks.

Financial Strength and Business Highlights

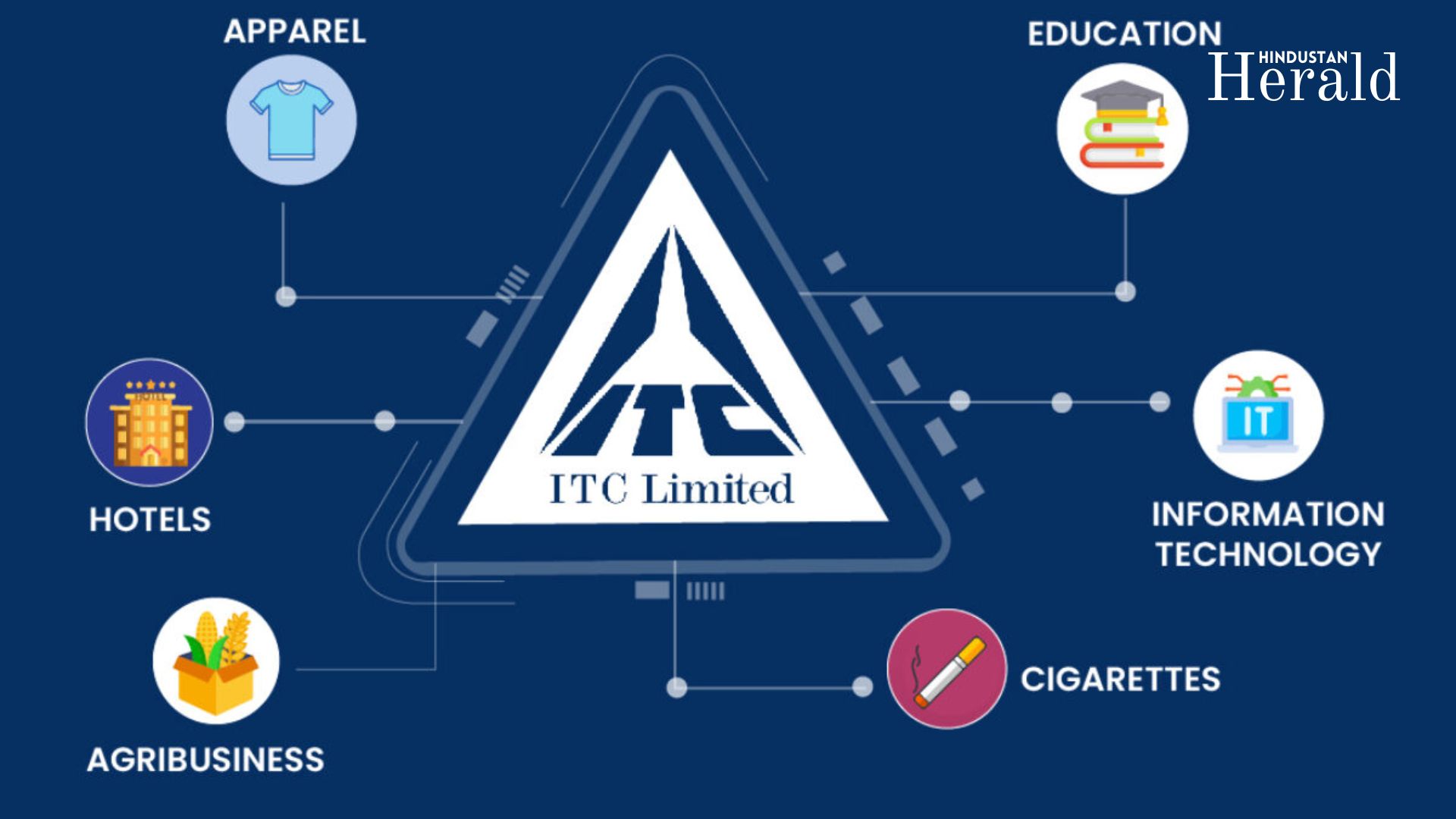

ITC’s strength lies in its diversified business model across:

- Cigarettes – Strong margins and market dominance.

- FMCG – Others – Packaged food, personal care, stationery.

- Hotels – Rebounding with India’s travel sector boom.

- Agri-Business – Consistent rural outreach and exports.

- Paperboards & Packaging – Leveraging the rise in ecommerce.

Key financial metrics (FY24 estimates):

| Metric | Value |

|---|---|

| Revenue | ₹78,000 Cr |

| Net Profit | ₹16,100 Cr |

| EBITDA Margin | 34.2% |

| ROE | 25.6% |

| Debt-Free Status | Yes |

| Dividend Yield | 2.50% |

ITC remains one of the few debt-free large-cap conglomerates with healthy cash reserves and consistent dividend payouts, reinforcing its appeal in volatile markets.

Strategic Developments and Growth Drivers

ITC continues to implement a multi-sector expansion plan with the following key initiatives:

- De-merger of Hotel Business: Slated for completion in 2025, unlocking valuation and operational efficiency.

- FMCG Growth: New product launches in snacks, personal care, and dairy verticals.

- Tech Adoption: ITC e-Choupal 4.0 and AI-enabled agricultural advisory systems.

- Green Packaging and ESG focus: Renewable energy integration and sustainable packaging driving long-term investor interest.

These initiatives are part of ITC’s long-term vision of transitioning from a tobacco-centric conglomerate to a modern diversified FMCG powerhouse.

Technical Analysis: Holding Steady Above Support

| Indicator | Reading | Interpretation |

|---|---|---|

| RSI (14-day) | 53 | Neutral zone |

| 20 DMA | ₹408.50 | Support level |

| 50 DMA | ₹412.00 | Resistance zone |

| Bollinger Bands | Squeezing | Range-bound breakout possible |

| MACD | Positive | Mild bullish crossover |

ITC is consolidating between ₹407 and ₹412. A breakout above ₹414 could lead to short-term targets of ₹425–₹440. Conversely, ₹405 remains a key downside support.

Peer Comparison and Valuation

| Company | P/E Ratio | Dividend Yield | Market Cap (Cr) |

|---|---|---|---|

| ITC Ltd | 25.46 | 2.50% | ₹5.13 Lakh Cr |

| HUL | 58.90 | 1.20% | ₹6.55 Lakh Cr |

| Nestlé India | 75.20 | 1.15% | ₹2.51 Lakh Cr |

ITC trades at a discounted valuation compared to peers, especially considering its diversified revenue model and free cash flow strength. This makes it a value bet in the FMCG segment.

Institutional Sentiment and Shareholding Pattern

As of March 2025:

- Foreign Institutional Investors (FIIs): 13.2%

- Mutual Funds: 9.7%

- Retail & HNI Investors: 23.4%

- LIC & Insurance Cos: 18.5%

- Promoters: Nil (Public company structure)

Recent mutual fund inflows into ITC have picked up, citing the stock’s valuation comfort, dividend yield, and low volatility profile.

Risks and Challenges

Despite its strengths, ITC faces headwinds:

- Cigarette taxation remains a perennial risk.

- Hotel de-merger execution delays could dampen sentiment.

- Slow ramp-up in some FMCG sub-brands may cap growth.

- Global ESG concerns around tobacco-linked revenues.

However, ITC has been proactive in addressing regulatory risk and enhancing ESG compliance, which should aid long-term reputation.

Expert Views

“ITC’s current consolidation phase makes it attractive for long-term investors. We expect 12–15% upside over the next 6 months,” said Ravi Menon, Analyst at Motilal Oswal.

“Its strong dividend payout and debt-free balance sheet act as a safety cushion during market dips,” noted Jyoti Sharma, Head of Research at Axis Securities.

ITC Remains a Strong Defensive Bet with Upside Potential

With today’s ₹3.85 gain taking the stock to ₹409.90, ITC Ltd continues to stand tall as a defensive powerhouse amid broader market uncertainties. The stock’s attractive yield, stable earnings, diversified portfolio, and de-merger roadmap make it a compelling long-term holding.

While short-term moves may be range-bound, the long-term story remains intact, with multiple value unlocking triggers lined up for FY2025.

Investors looking for a safe yet growth-aligned FMCG stock should continue to keep ITC Ltd on their radar.

The Hindustan Herald Is Your Source For The Latest In Business, Entertainment, Lifestyle, Breaking News, And Other News. Please Follow Us On Facebook, Instagram, Twitter, And LinkedIn To Receive Instantaneous Updates. Also Don’t Forget To Subscribe Our Telegram Channel @hindustanherald