ITC Stock Increases 0.15% Today: Steady Performance Amid Market Volatility

ITC sees a slight 0.15% increase today, reflecting stability in the stock despite market fluctuations.

Table of Contents

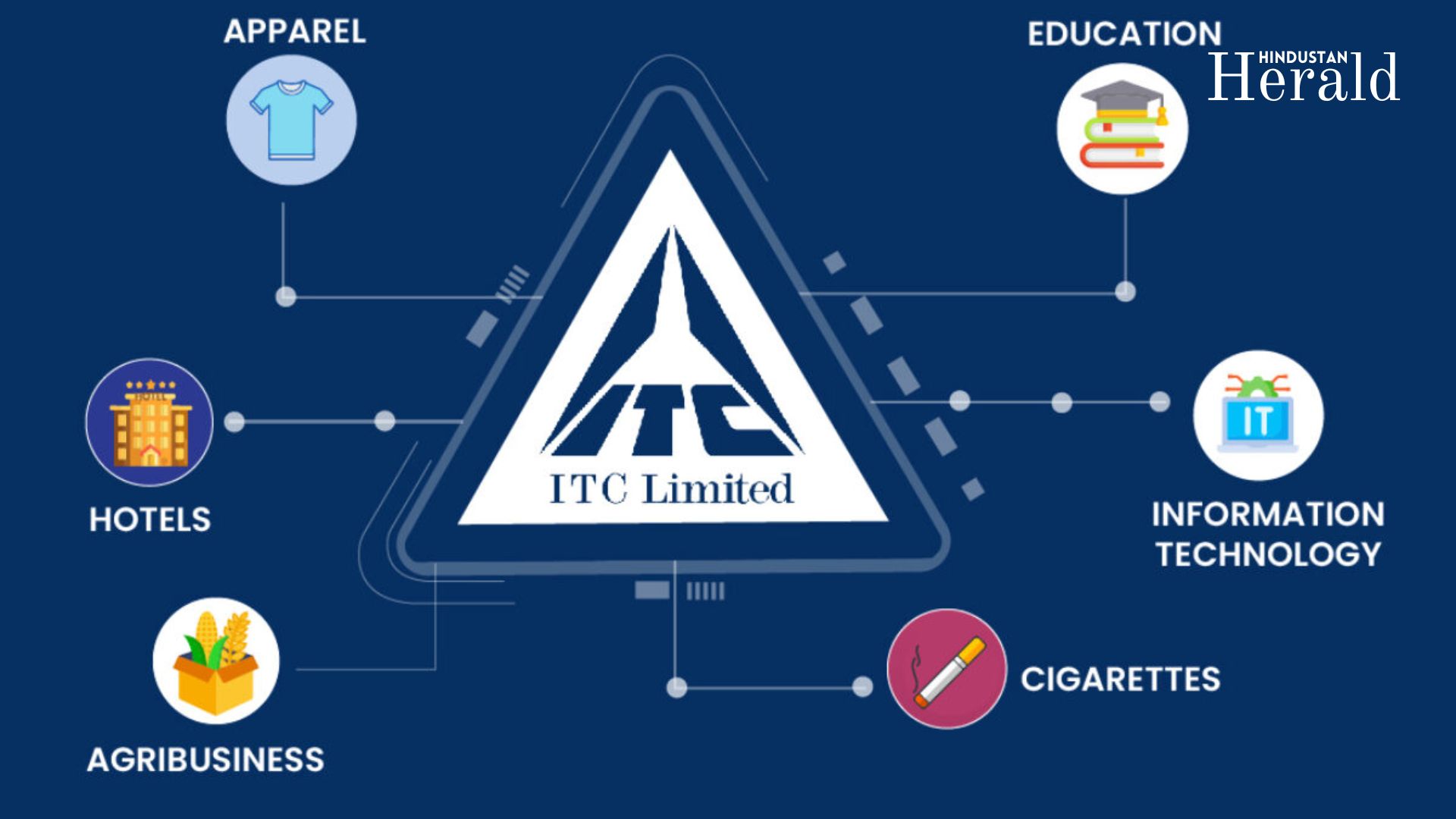

ITC Ltd. has seen a modest rise of 0.15% today, increasing by INR 0.65 to reach INR 422.20. The stock has shown steady performance despite broader market volatility, reflecting strong investor sentiment towards the company. ITC’s diversified business model, spanning FMCG, hotels, paperboards, and packaging, continues to make it a reliable choice for investors.

Key Drivers Behind Today’s Increase

The slight rise in ITC’s stock price can be attributed to its consistent business performance across sectors. ITC’s leadership in the FMCG sector, particularly in its cigarette and food divisions, along with its solid growth in the paperboards and packaging sectors, supports its steady stock performance. Despite market fluctuations, ITC continues to offer stability and steady returns to long-term investors.

Investor confidence in ITC is further strengthened by its strong dividend yield of 2.43%, making it an attractive option for income-focused investors. The company’s consistent financial results, coupled with its diversified business operations, help provide a hedge against sector-specific risks.

Investor Sentiment & Market Outlook

Investor sentiment around ITC remains stable, as the company’s diversified portfolio provides a buffer against volatility in any single business unit. ITC’s low P/E ratio of 26.23 reflects its steady, reliable earnings stream, and the stock remains a top pick for conservative investors.

While the stock has faced pressure in recent months due to concerns about the FMCG sector’s growth, ITC’s stronghold in key markets and its aggressive diversification strategy in non-cigarette businesses help mitigate these risks. The current market conditions provide an opportunity for investors to buy into the stock at attractive levels, especially considering its strong dividend yield.

Technical Outlook for ITC

On the technical front, ITC is currently trading within a tight range, with resistance at INR 429.20 and support at INR 420.55. The stock has shown resilience and could break out above INR 429.20 if market sentiment remains positive. However, any dip below INR 420.55 could lead to further consolidation or potential downside risk.

The stock is expected to remain in this range unless there are new triggers in the market or in ITC’s performance that push the price higher. Traders should watch for any significant breakouts or pullbacks around the identified support and resistance levels.

Key Support and Resistance Levels

- Support Levels: INR 420.55, INR 415

- Resistance Levels: INR 429.20, INR 435

These levels are important for traders to monitor. A breakout above INR 429.20 could trigger further upward movement, while a decline below INR 420.55 might lead to a re-test of lower levels.

Recommendations for Investors

For short-term traders, ITC offers a stable trading opportunity, with potential upside if the stock breaks through INR 429. Traders should consider setting stop-loss orders around INR 420 to manage risk effectively.

For long-term investors, ITC remains a strong pick due to its diversified business model and attractive dividend yield. Investors should consider holding or accumulating ITC shares, especially during market pullbacks, as it continues to benefit from strong demand in multiple sectors.

Steady Outlook for ITC Ltd.

ITC’s performance today demonstrates stability amid market fluctuations. The company’s solid fundamentals and diversified operations provide a strong foundation for long-term growth. While the stock’s price increase today is modest, its consistent performance and strong dividend yield make it an attractive investment option for those seeking stability in the Indian stock market.

The Hindustan Herald Is Your Source For The Latest In Business, Entertainment, Lifestyle, Breaking News, And Other News. Please Follow Us On Facebook, Instagram, Twitter, And LinkedIn To Receive Instantaneous Updates. Also Don’t Forget To Subscribe Our Telegram Channel @hindustanherald