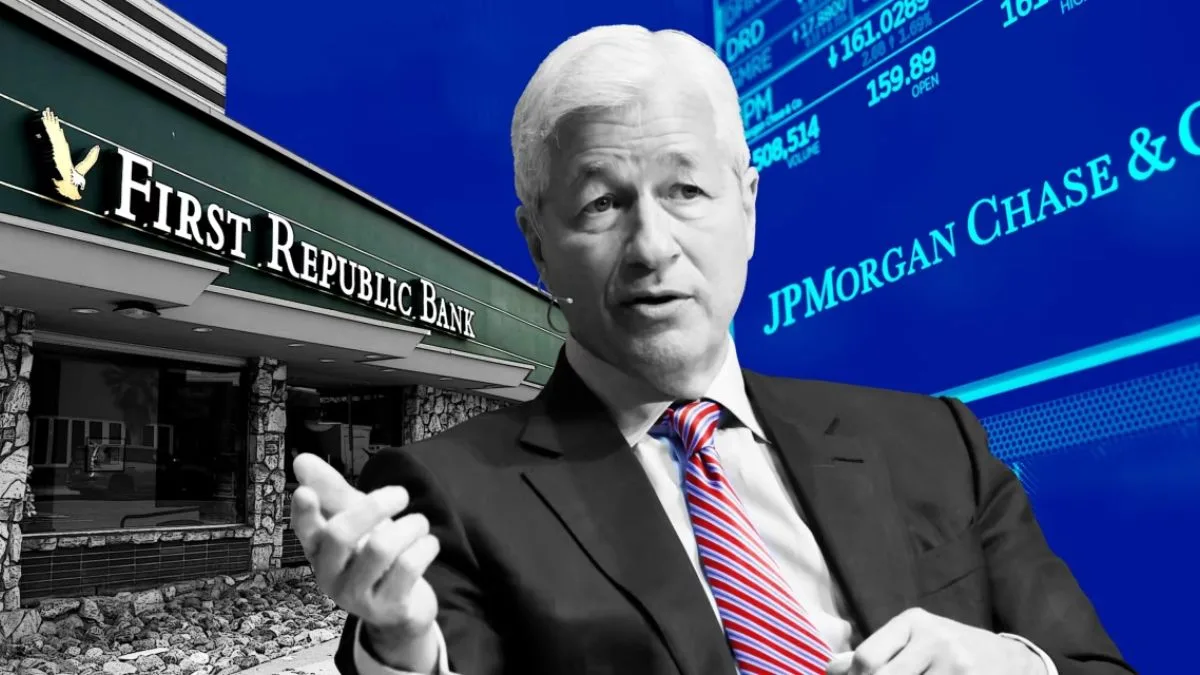

The Failed Deal between First Republic Bank and JPMorgan Chase Bank: Reasons and Implications

The proposed deal between First Republic Bank and JPMorgan Chase Bank has recently become a topic of discussion in the financial world. However, the deal did not materialize, leaving many to wonder what went wrong. In this article, we will explore the reasons behind the failed deal and its implications for the two banks.

Background

First Republic Bank is a well-known bank that operates in several states across the United States. The bank offers a wide range of services, including personal banking, business banking, and wealth management. JPMorgan Chase Bank, on the other hand, is a global financial institution that offers investment banking, commercial banking, and asset management services.

The Failed Deal

The proposed deal between First Republic Bank and JPMorgan Chase Bank was aimed at expanding the business of the former. However, the deal failed to materialize due to several reasons. Firstly, the two banks had different valuations, which made it difficult to reach an agreement. Additionally, there were concerns about the regulatory approval process, which could have delayed the deal for an extended period. The lack of agreement on several key issues also contributed to the failure of the deal.

Implications

The failure of the First Republic Bank-JPMorgan Chase Bank deal has significant implications for both banks. Firstly, First Republic Bank may have to look for alternative ways to expand its business. Secondly, JPMorgan Chase Bank may have missed an opportunity to acquire a bank that could have boosted its presence in the United States. Additionally, the failed deal could impact the stock prices of both banks.

The proposed deal between First Republic Bank and JPMorgan Chase Bank failed due to several reasons, including different valuations, regulatory approval process concerns, and lack of agreement on key issues. The implications of the failed deal are significant for both banks, and they may have to explore alternative strategies to achieve their business objectives.

To summarize, the failure of the First Republic Bank-JPMorgan Chase Bank deal highlights the challenges that banks face when trying to expand their business. The lessons learned from this experience can be useful for other financial institutions looking to grow their business in the future.

The Hindustan Herald Is Your Source For The Latest In Business, Entertainment, Lifestyle, Breaking News, And Other News. Please Follow Us On Facebook, Instagram, Twitter, And LinkedIn To Receive Instantaneous Updates. Also Don’t Forget To Subscribe Our Telegram Channel @hindustanherald