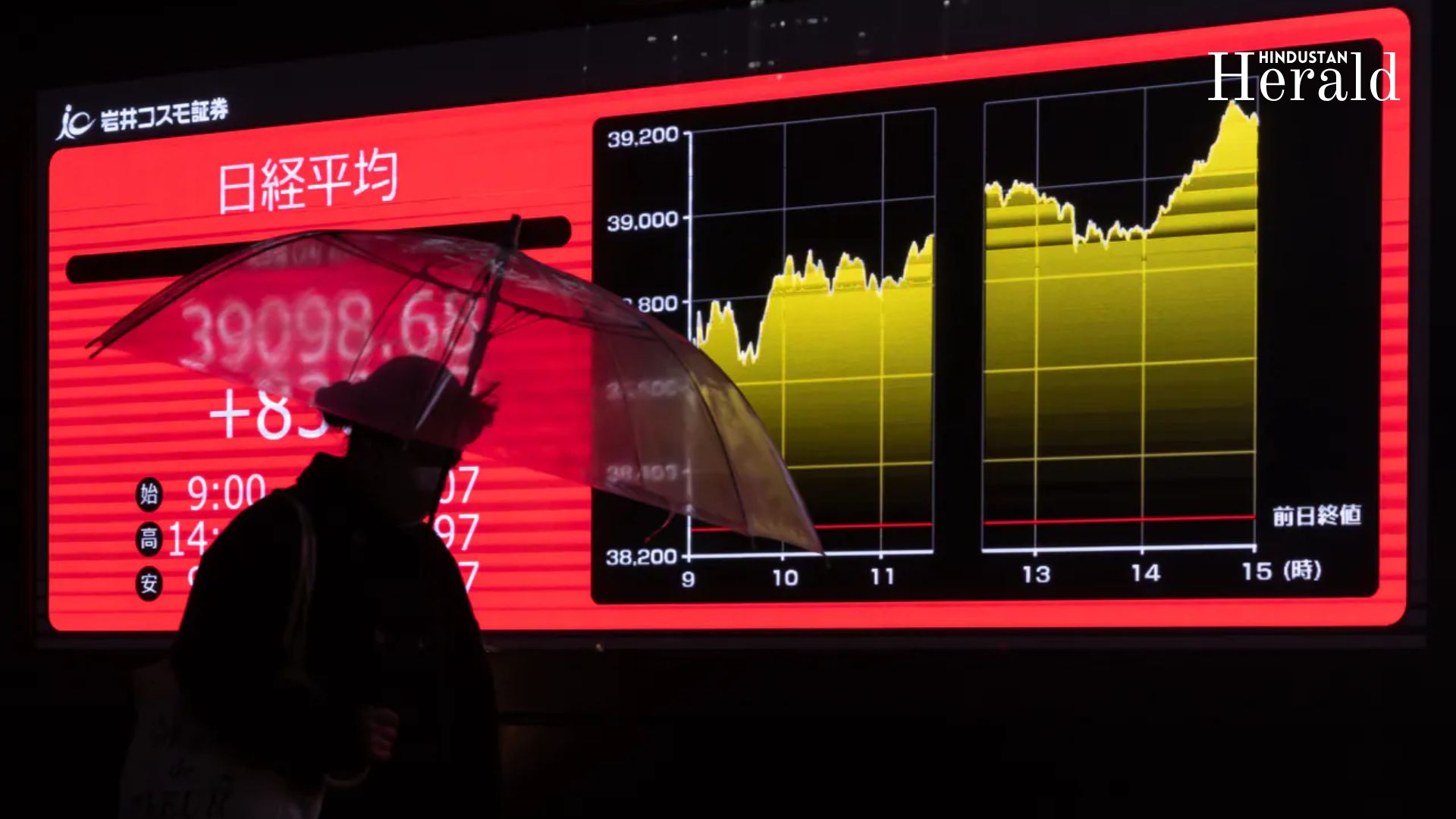

Nasdaq Surge Signals Bullish Start for Japan’s Nikkei 225

With Nasdaq's strong rally on Friday, traders are eyeing a bullish opening for Japan's Nikkei 225 as trading resumes in Tokyo.

Key Highlights:

Nikkei 225 Opening Prediction: 28 April Outlook After Nasdaq’s 1.26% Surge

As global investors digest last week’s strong U.S. market performance, attention now turns to Tokyo, where the Nikkei 225 opening prediction points to a bullish start on Monday, April 28, 2025.

The Nasdaq Composite Index ended Friday’s session on a high note, gaining +1.26% to close at 17,382.94, buoyed by upbeat corporate earnings and easing fears around the Federal Reserve’s monetary policy. This sets a confident tone for Asian markets, particularly Japan.

Why Nasdaq Matters for Nikkei 225

Japan’s benchmark Nikkei 225 often mirrors trends in the U.S., especially the Nasdaq, due to their overlapping focus on technology and export-driven companies.

- Strong Nasdaq close: +216.90 points on April 25

- Positive momentum across Asian peers: TAIEX +2.02%, KOSPI +0.95%

- Favorable U.S. earnings season: Leading to global risk-on sentiment

Given this backdrop, market watchers anticipate a gap-up opening for the Nikkei 225 as trading resumes on Monday.

What to Expect at the Open

Based on overnight cues and Friday’s global close:

- Likely Opening Trend: Bullish

- Expected Opening Range: +200 to +300 points

- Projected Opening Level: Around 35,900–36,000, assuming no domestic headwinds

This projection reflects a 0.6% to 0.9% gain, driven by global tailwinds and renewed appetite for tech and industrials.

Key Drivers for April 28 Trading

Several factors are aligning to support a strong start for the Nikkei 225:

- Tech sector boost: Japanese technology giants may gain from the Nasdaq rally.

- Weak yen advantage: A softer yen continues to benefit Japanese exporters.

- Global optimism: Sentiment in equities has turned positive across regions.

Who Will Be Affected

- Retail and institutional investors watching Nikkei and ETFs like EWJ

- Japanese exporters such as Toyota, Sony, and Hitachi

- Tech-linked firms in semiconductors and robotics

- Currency traders watching USD/JPY for volatility clues

What This Means for You

If you’re an investor in Japanese markets or holding Asia-Pacific ETFs, today’s Nikkei open could present short-term trading opportunities. With the market tracking Wall Street’s momentum, bullish positions may benefit early in the session, especially in technology and industrial segments.

The Bigger Picture

While a strong Nasdaq close gives the Nikkei 225 a positive lead-in, attention will quickly shift to domestic earnings, BOJ policy statements, and currency movements. Sustaining gains will depend on follow-through from both domestic and global catalysts in the week ahead.

Stay updated with the latest from Hindustan Herald — your trusted source for

Politics, Business, Sports, Entertainment, Lifestyle, Breaking News, and More.

📲 Follow us on Facebook, Instagram, Twitter, LinkedIn, and YouTube

🔔 Join our Telegram channel @hindustanherald for real-time news alerts.