Will Nikkei 225 Sustain Its Bullish Momentum After Nasdaq’s Slide?

Table of Contents

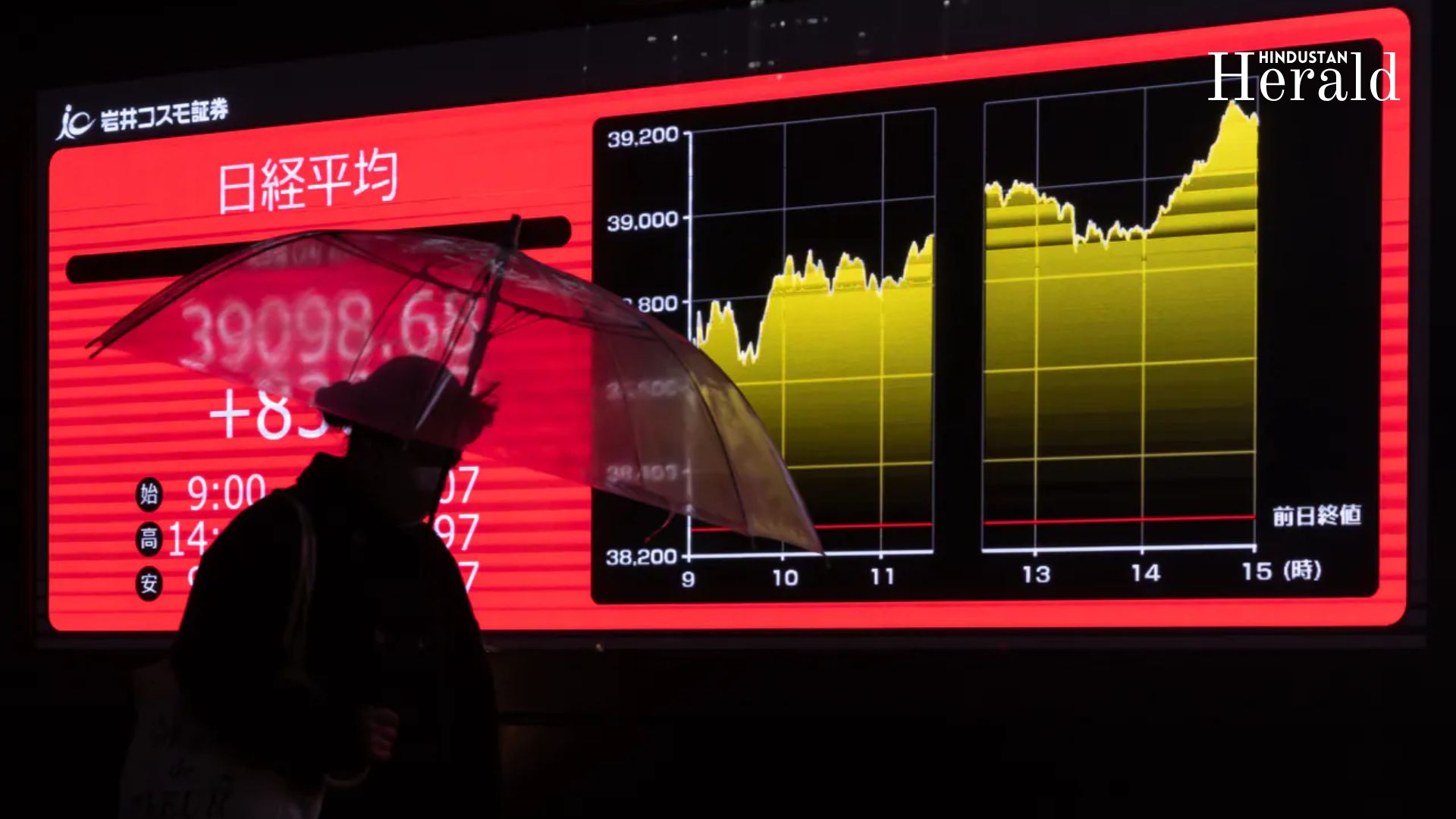

The Nikkei 225 ended 8 April with a powerful 6.03% gain, surging 1,876 points to close at 33,012.58. The rally came despite mixed signals from global markets. However, the Nasdaq Composite, which heavily influences tech-driven Asian stocks, tumbled by 335.35 points (-2.15%) on the same day.

Nasdaq Composite Crash: What Triggered the Drop?

The Nasdaq opened at 16,181.04 and quickly slid throughout the session, closing at 15,267.91. Major tech stocks faced sell-offs due to:

- Concerns about interest rate hikes following stronger-than-expected inflation indicators.

- Profit booking after a recent rally in AI and tech stocks.

- Geo-political uncertainties, particularly in Taiwan and the Middle East, adding to investor caution.

The decline in Nasdaq typically reflects global risk-off sentiment, which often impacts Asian markets in the following sessions.

Why Nikkei 225 Defied the Trend on 8 April?

Despite the U.S. market’s weakness, the Nikkei’s massive jump was fueled by:

- Weaker Yen, which benefits Japanese exporters.

- Strong machinery orders and tech export data from Japan.

- Anticipation of stimulus measures from the Bank of Japan to support economic growth.

Investors also showed confidence in domestic sectors like automotive, robotics, and semiconductors, which are more resilient to U.S. swings.

Key Technical Levels for Nikkei 225 – 9 April 2025

Here’s what traders and investors should watch:

- Immediate Resistance: 33,300 (psychological barrier)

- Major Resistance: 33,500 (March’s closing high)

- Support Zone: 32,500 – 32,700

- Trend Indicator: Sustained closing above 33,000 signals bullish continuation

Predicted Behavior: Nikkei 225 Likely to Open Flat-to-Positive

Taking cues from the Nasdaq’s steep decline, the Nikkei 225 may see:

- Mild profit booking at open, especially in export-heavy sectors.

- However, strong domestic fundamentals and a technical breakout above 33,000 could support further gains.

- If the index holds above 32,700 during early trading, expect another attempt toward 33,300–33,500 levels intraday.

Sectoral Focus for 9 April:

- Tech Stocks: May face slight pressure due to Nasdaq’s pullback.

- Automotive & Robotics: Likely to stay buoyant on export optimism.

- Banking & Insurance: Expected to be neutral with a watch on BOJ policy signals.

Impact of U.S. Markets on Asian Stocks

While U.S. indices like the Nasdaq heavily influence Asian sentiment, Japan’s market sometimes decouples due to domestic economic data, currency moves, and BOJ policy stance. The divergence on 8 April is a classic example.

If Japan’s domestic indicators remain strong and the yen continues its weakness, the Nikkei could sustain gains even in the face of Wall Street volatility.

Expert Views on Nikkei 225’s Next Move

Top analysts from Nomura and Daiwa Securities suggest:

“If the index stays above 33,000 for two consecutive sessions, it could trigger algorithmic buy signals and invite more FII flows into Japanese equities.”

“Nasdaq’s drop will have limited impact unless it causes a chain reaction in other Asian bourses. Watch China and South Korea for confirmation.”

Conclusion: Nikkei 225 May Stay Resilient Despite Nasdaq’s Negative Cues

The Nikkei 225 has shown remarkable strength against global uncertainty. While U.S. market weakness could lead to early jitters on 9 April, the broader uptrend remains intact as long as key support levels hold. Market watchers should look for consolidation followed by fresh buying in selected sectors.

Stay tuned for real-time updates.

FAQs

Q1: Why did the Nasdaq fall sharply on 8 April?

The Nasdaq dropped due to inflation worries, interest rate hike fears, and tech sector profit booking.

Q2: Will Nasdaq’s fall affect the Nikkei 225?

Partially. While some correlation exists, the Nikkei often responds more to local economic cues and currency movements.

Q3: What is the prediction for Nikkei 225 on 9 April?

The market is expected to open flat to slightly positive, with resistance at 33,300 and support at 32,700.

Q4: Which sectors in Japan are likely to perform well?

Robotics, automotive, and machinery-related sectors may remain strong due to export tailwinds.

Q5: What should traders watch today?

Key levels at 33,000 (support) and 33,300 (resistance), along with currency fluctuations and BOJ commentary.

The Hindustan Herald Is Your Source For The Latest In Business, Entertainment, Lifestyle, Breaking News, And Other News. Please Follow Us On Facebook, Instagram, Twitter, And LinkedIn To Receive Instantaneous Updates. Also Don’t Forget To Subscribe Our Telegram Channel @hindustanherald