In a unanimous decision, the 6-member Monetary Policy Committee (MPC) of the Reserve Bank of India (RBI) has chosen to maintain the key interest rate at 6.50% for the third consecutive time. This move comes amidst concerns over rising food prices and potential inflationary pressures. Here are the key takeaways from the recent MPC meeting:

Maintaining Status Quo

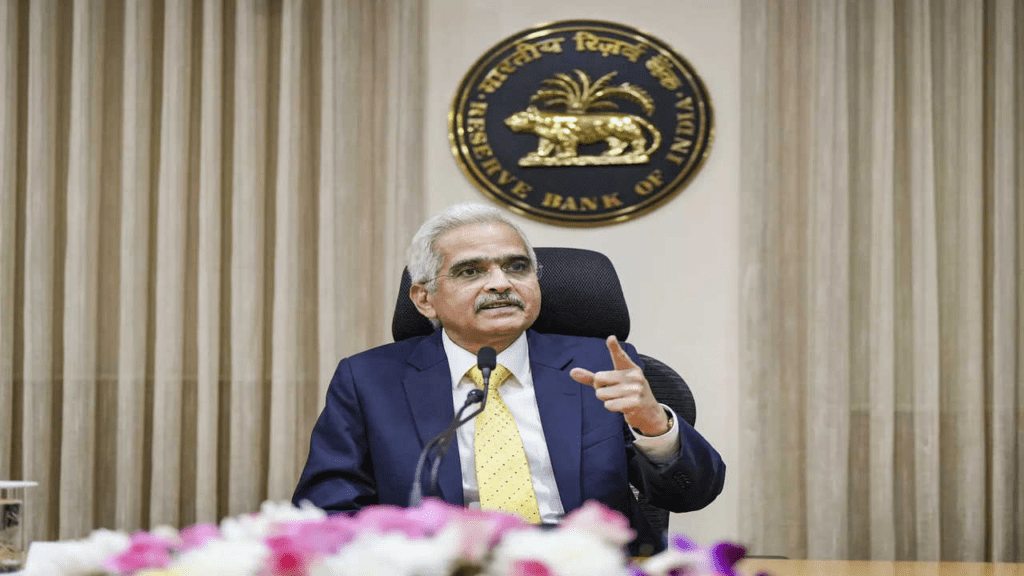

The RBI’s MPC, led by Reserve Bank Governor Shaktikanta Das, has opted to retain the policy repo rate at 6.50%. This decision is in line with the central bank’s preparedness to respond appropriately to any shifts in the economic situation.

Inflation Concerns Amidst Vegetable Price Surge

The MPC’s decision is influenced by the anticipation of a surge in retail inflation during July-August, primarily driven by higher vegetable prices. This concern over inflation has factored into the decision to keep the interest rate unchanged.

Continued Caution Despite Previous Rate Hikes

Despite implementing six consecutive rate hikes totaling 250 basis points between May 2022 and April 2023, the RBI maintained a status quo in the past two MPC meetings held in April and June. This approach suggests a cautious stance in balancing inflation control with economic growth.

Economic Growth and Projections

The RBI’s outlook for India’s economic growth remains positive. Real GDP growth for the fiscal year 2023-24 is projected at 6.5%, with varying growth rates across quarters. The subsequent fiscal year, 2024-25, is expected to see a growth rate of 6.6%, with balanced risks.

Vigilance on Inflation Alignment

The MPC expressed its commitment to aligning inflation with the target of 4%, while also supporting growth. Despite global challenges such as elevated inflation, high debt levels, and geopolitical tensions, the MPC believes India is well-positioned to weather these challenges.

Addressing Inflation Upside Pressures

The recent spike in vegetable prices, particularly tomatoes, is expected to exert upward pressure on near-term headline inflation. However, this surge is predicted to correct as fresh market arrivals and improved monsoon progress alleviate the situation.

Current Account and External Debt

India’s current account deficit (CAD) remained contained at 2.0% of GDP in 2022-23, compared to 1.2% in the previous fiscal year. The country’s external debt to GDP ratio improved to 18.9% in March 2023 from 20.0% a year earlier.

UPI-Lite and Digital Payment Innovations

The RBI introduced measures to enhance digital payments, proposing an increase in the UPI-Lite limit to Rs 500 from Rs 200. The central bank also highlighted plans for “Conversational Payments” through AI-powered conversations and offline payments via NFC technology.

Frictionless Credit Delivery

A public tech platform is being developed to facilitate frictionless credit delivery, aiming to streamline the flow of digital information to lenders. Pilot projects for digitalizing lending processes, including Kisan Credit Card and dairy loans, have yielded positive results.

The RBI’s decision to maintain the repo rate and its cautious stance reflect a delicate balancing act between controlling inflation and sustaining economic growth. As India navigates a complex economic landscape, the central bank remains vigilant and adaptive to ensure stability and progress.

The Hindustan Herald Is Your Source For The Latest In Business, Entertainment, Lifestyle, Breaking News, And Other News. Please Follow Us On Facebook, Instagram, Twitter, And LinkedIn To Receive Instantaneous Updates. Also Don’t Forget To Subscribe Our Telegram Channel @hindustanherald