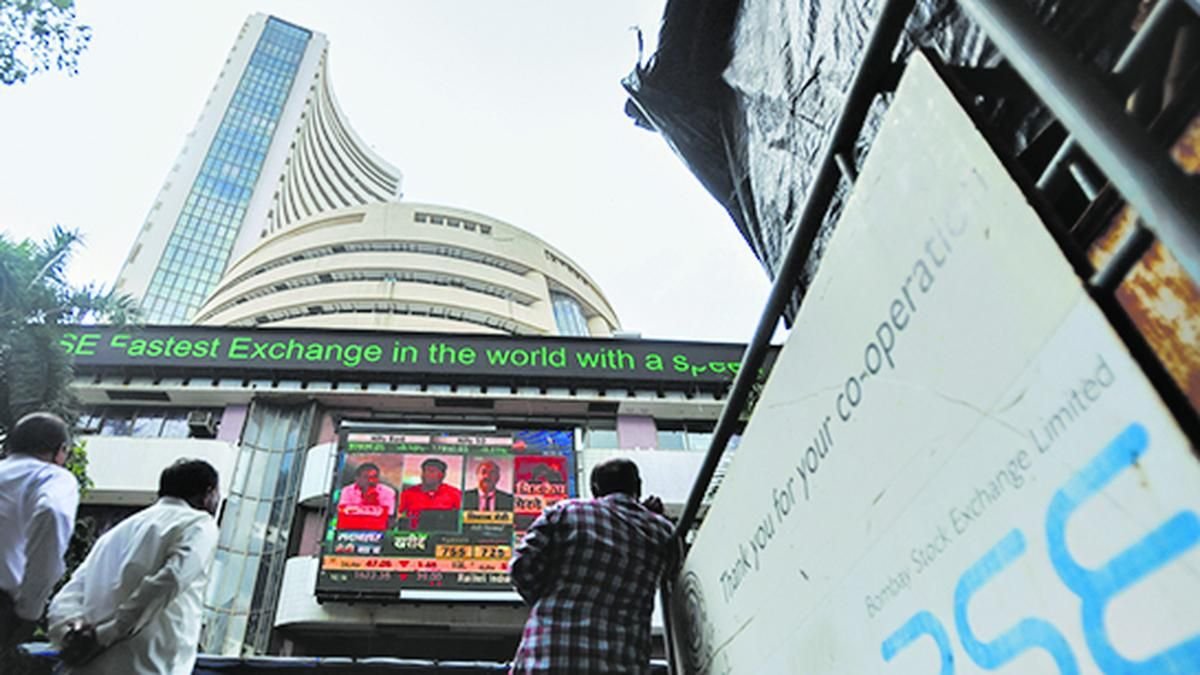

Sensex, Nifty Hit All-Time Highs Amid Robust Market Sentiment

In a significant milestone for the Indian stock market, the Sensex and Nifty indices soared to unprecedented levels during early trading today. Here’s a detailed look at the factors driving the surge and its implications.

Market Performance Overview

Both Sensex and Nifty opened the day on a positive note, reflecting robust investor sentiment. This marks a continuation of the bullish trend observed in recent sessions, with key sectors contributing to the rally.

Key Drivers Behind the Surge

- Positive Global Cues: Favorable trends in international markets have bolstered domestic confidence.

- Strong Corporate Earnings: Robust earnings reports from leading companies have fueled optimism.

- FII Inflows: Increased foreign institutional investments have provided further support.

Sectors Leading the Charge

The rally was broad-based, with significant gains in:

- Banking and Financials: Banks posted impressive performances, led by high trading volumes.

- IT and Tech Stocks: Continued demand in technology shares helped sustain market momentum.

- Energy and Infrastructure: Steady growth in these sectors added to the positive sentiment.

Implications for Investors

The all-time highs achieved by Sensex and Nifty signal growing confidence in the Indian economy. For investors, this may present opportunities, but caution is advised as market volatility remains a possibility.

Outlook for the Day

Analysts suggest that the market may continue to trend upward, but global developments and macroeconomic data will play a crucial role in determining the day’s trajectory.

The Hindustan Herald Is Your Source For The Latest In Business, Entertainment, Lifestyle, Breaking News, And Other News. Please Follow Us On Facebook, Instagram, Twitter, And LinkedIn To Receive Instantaneous Updates. Also Don’t Forget To Subscribe Our Telegram Channel @hindustanherald