Tether co-founder Reeve Collins believes the UST crash could spell the end of most, if not all, algorithmic stablecoins. In an interview at the World Economic Forum in Davos, Reeves stated that the collapse of TerraUSD “did not come as a surprise” and that algorithmic stablecoins have not yet seen the worst of it. He believes that other algorithmic stablecoins will soon follow UST, bringing an end to their kind.

It’s unfortunate that the money… was lost, but it’s not unexpected. It is a stablecoin supported by an algorithm. Therefore, a group of intelligent individuals are determining how to peg something to the dollar “Collins said to CNBC

“…many investors withdrew their funds over the past few months after realizing the venture was unsustainable.” As a result, the collision caused a domino effect. And it will almost certainly spell the end for the vast majority of algo stablecoins “he added.

Stablecoins are a type of cryptocurrency typically backed by a tangible asset. TerraUSD, also referred to as UST, is an algorithmic stablecoin designed to be pegged to the U.S. dollar.

Unlike stablecoins such as Tether and USD Coin, which are backed by fiat currencies and government bonds to maintain their dollar peg, UST was governed by an algorithm.

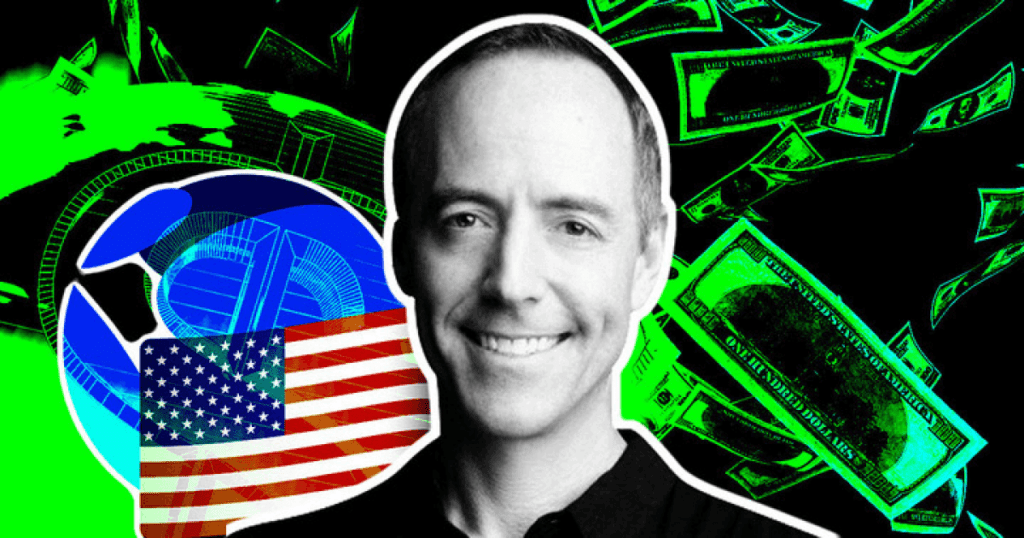

Meanwhile, Jeremy Allaire, CEO of Circle, one of the companies behind the issuance of the USDC stablecoin, believes that algorithmic stablecoins will continue to be developed.

“I compare algorithmic stablecoins to the “Fountain of Youth” or “Holy Grail.” Some have referred to it as financial alchemy. Consequently, financial alchemists will continue to work on the magic potion to create these things and discover… the Holy Grail of a stable value, algorithm-based digital currency. So I am confident that this will continue “Allaire said to CNBC: